Outlook 2017 - What we Learned

By Andrew Trounson

The Economic and Social Outlook Conference 2017 featured some of Australia’s leading policy minds; our academics report on key sessions

If Australian governments had to submit a report card on their policy making record over the last ten years or so, they would do well to feed it to the dog.

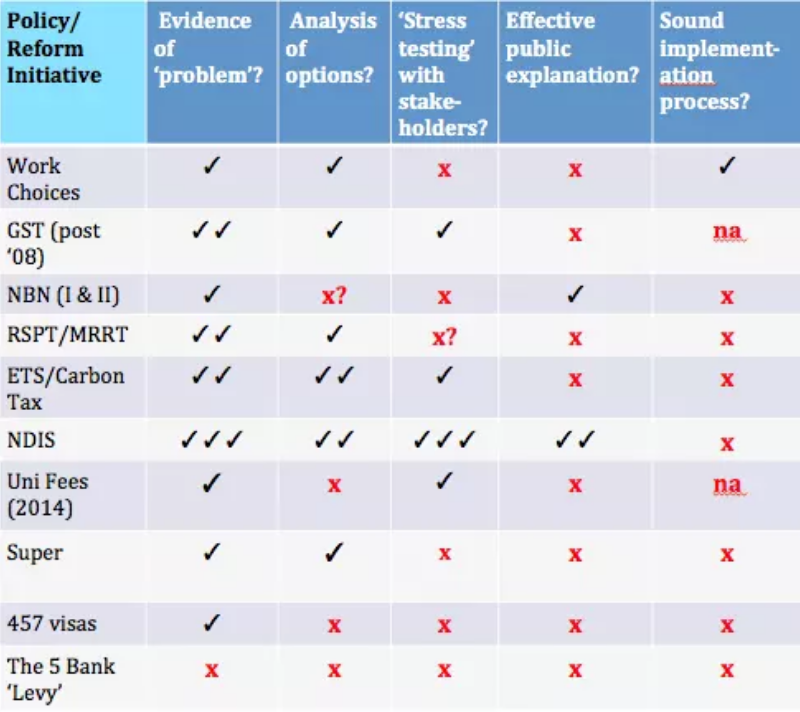

At the final session of the 2017 Economic and Social Outlook Conference, Melbourne Institute Professorial Fellow and former Productivity Commission chief Professor Gary Banks issued just such a report card on a list of reforms. When it came to rating the quality of analysis and consultation behind the reforms most were scored either as minimal or effectively nonexistent.

“Under-prepared policies are being foisted on an unprepared public,” Professor Banks told the conference. “As a result there has been a succession of policy misfires and reversals in Europe and North America, and not least in Australia.”

Viewed through such a prism, it isn’t surprising that voter anger and disenchantment have stoked a rise in populism across Western democracies. How governments can better respond to the disenchantment was a key theme of the conference. And according to Melbourne Institute Director Professor Abigail Payne, the answer lies in more reliance on data, testing, evaluation and consultation, and policy focus on micro and targeted reforms.

“When you think about voter disenchantment it probably isn’t one single issue, it is a combination of issues,” says Professor Payne. “So we have to think holistically about what are the different policies, and then think about how we target policies and how we test them.”

We're talking voter disenchantment with Abigail Payne, Director of @MelbInstUOM #AusESOC https://t.co/zkOgGnAg2e

— University of Melbourne (@unimelb) July 21, 2017

The conference considered policy areas ranging from welfare, health, and education, to energy, the workplace, finance industries and foreign affairs. Here are what one of our academics took out of the sessions:

Panel members: Dr David Byrne (Moderator, University of Melbourne), The Hon. Josh Frydenberg MP (Minister for Environment and Energy), The Hon. Mark Butler MP (Shadow Minister for Climate Change and Energy)

This session largely focused on the energy trilemma; how do we ensure stable energy supply, while keeping energy prices down, and meeting Australia’s commitments to mitigate climate change under the Paris Agreement?

Climate and energy policy, has, in recent years created some of the most divisive politics in Australia. This session provided a sense of relief that political parties may be moving on, together, on energy policy; particularly as the country requires investment in lower-emissions energy generation with the ageing coal-fired power fleet being retired in coming years.

Both the Minister and Shadow Minister were aligned on various policy issues, noting both parties’ support for 49 of 50 recommendations from the recent Finkel Review into the future of the electricity grid.

The one recommendation remaining in question, a Clean Energy Target (CET), has received the support of Labor. The Coalition continues internal discussions, which includes consultation with the Australian Energy Market Operator to ensure a secure amount of base load power generation. Minister Frydenberg revealed his strong inclination to support low energy prices over mitigating climate change. Shadow Minister Butler, in contrast, alluded to the need to have a mechanism to mitigate climate change, such as the CET.

And there’s the rub: will the almighty dollar or the climate win out? This tension clearly still exists between the Coalition and Labor, despite the welcome bi-partisanship in many aspects of energy policy.

The rise of populism with Prof Lisa Cameron @MelbInstUOM live at #AusESOC https://t.co/n056LZvhSx

— University of Melbourne (@unimelb) July 21, 2017

Panel members: Dee McGrath (Chair, IBM Global Business Services), Mark Cully (Department of Innovation, Industry and Science), Paul Jensen (University of Melbourne), Lisa Gropp (Business Council of Australia)

First up, Mark Cully showed that Australia is still some way off the productivity frontier (lagging the US by about 15 years), and discussed ways in which we might assist high-performing firms to improve performance, and also how to have the courage to allow low-performing firms to disappear. His work on small business innovation suggests that, consistent with international trends across the OECD, it is small businesses that are responsible for most job growth in Australia.

Paul Jensen emphasised the positive side of the innovation debate; arguing that the situation in Australia is much better than most people think, but highlighted two areas for improvement: university-industry collaboration, and skills development. Much more needs to be done if we are going to mimic the deep connections between industry and universities in say, Germany, Japan or the US. And the recent decision by the Government to constrain inflow of highly skilled workers will have serious effect on both academia and innovation. In a time of Brexit and Trump (and concerns around de-globalisation), the best thing Australia could do would be to take advantage of this by offering safe and secure visa rights for high-skilled workers.

The Trump doctrine with Prof @MichaelSWesley from @ANUasiapacific #AusESOC https://t.co/r9DIcZaN1Q

— University of Melbourne (@unimelb) July 21, 2017

Lisa Gropp pointed out that innovation (and productivity growth) comes from many sources including learning-by-doing, management re-organisation and the like, not just technological invention. She emphasised the important role the government plays in getting regulation policy settings right.

Panel members: Professor Bruce Preston (Chair, University of Melbourne), Senator Katy Gallagher MLA, Michele Bullock (Reserve Bank of Australia), Professor Kevin Davis (University of Melbourne)

Panel members were supportive of the so-called four pillars policy (which prohibits any merger or acquisition between the four major banks), noting it did not prohibit competition, but rather restricted further market concentration.

Kevin Davis showed a range of statistics revealing the banking sector does not appear unusual on international comparisons, except perhaps in terms of the financial sector’s contribution to GDP.

Michelle Bullock noted the major banks appear relatively efficient and strong, on the basis of international comparisons of cost-to-income ratios and return on equity. She also noted the importance of an effective supervisory role to a strong banking system. Since the global financial crisis there has been considerable and ongoing effort, both within Australia and abroad, to develop regulatory frameworks that are responsive and efficient in the face of future bank failures.

The only significant disagreement amongst panellists concerned the case for a Royal Commission into the major Banks. Senator Katy Gallagher presented Labor’s case, citing a range of gross failures to protect consumer’s interests. In response Kevin Davis questioned its value, suggesting ASIC already had the authority and powers to deal with relevant concerns, but lacked the resources. Despite disagreement about the means, all agreed on the desired end: to raise ethics and standards in the banking industry, and to improve consumer’s financial literacy and trust in banking services.

What are the challenges for policy makers amidst the uncertainty? Prof @GlynDavisVC live from #AusESOC #auspol https://t.co/59e8GxVfzV

— University of Melbourne (@unimelb) July 20, 2017

Panel members: Professor Anthony Scott (Chair, University of Melbourne), The Hon. Catherine King MP, Dr Jeremy Sammut (Centre for Independent Studies), Dr Michael Gannon (Australian Medical Association)

Tony Scott discussed how our complacency about the health care system means we fall behind other countries in terms of equity, especially for Indigenous people.

Catherine King noted that, after 33 years, Medicare is due for reform, but not replacement. Three proposals for reform should include: focus on primary and preventive health care strategies; response to evidence that many Australians struggle to access primary and secondary care because of cost; and investment in public hospitals, thereby maintaining universal free treatment.

Michael Gannon’s priorities for Medicare included adequate long-term public hospital funding; maintenance of activity-based-funding; complementary balance of public and private hospital care; and more support for GPs, as cornerstones of primary health care provision. The AMA vehemently resists any reduction in hospital funding.

Dr Jeremy Sammut said too much is spent on one-off fees for doctors’ services and expensive hospital care, instead of non-hospital-based preventive care, although he highlighted that there is limited evidence for what works in preventive care and the current health system remains unsuited to this agenda. Novel approaches are required to help those affected by chronic disease to access and navigate the fragmented system. Dr Sammut proposed ‘capitated funding’ be allocated to providers to front load spending on a per person basis, with financial incentives to manage chronic disease outside hospital.

The session closed with consensus that Medicare needs to be strengthened, with better and more targeted use of funding and incentives to assist those with chronic disease.

Panel members: Professor David Ribar (Chair, University of Melbourne), Roland Manderson (Anglicare Australia), Richard Spencer (Productivity Commission)

Given that welfare is the federal government’s largest expenditure item, it is not surprising that it is again turning to welfare reform to patch the budget. However, this time the Liberal Government, is taking a new approach, a key part of which is the ‘Priority Investment Approach to Welfare’. This system uses actuarial analysis to quantify the lifetime welfare cost of Australians, with the view of targeting interventions at those who pose the highest cost.

The connection between love and money w/ Ruth Weston @FamilyStudies live at #AusESOC https://t.co/qaBPw7eGe8

— University of Melbourne (@unimelb) July 21, 2017

Roland Manderson criticised the actuarial approach as too narrow to encapsulate the objectives of the welfare system. He pointed to the important social benefits from welfare that are not included in the actuarial approach, such as freeing young mothers to establish good child rearing practices. He was also highly sceptical of the government’s motives, pointing to the low cost of unemployment and single parent benefits compared to that of the pension and superannuation tax concessions and questioning the introduction of random drug testing of welfare recipients.

The Government’s $96.1m Try, Test and Learn Fund will finance and evaluate a suite of proposed welfare interventions from relevant Commonwealth agencies and external experts over a number of years. The idea is the successful ones will continue to be funded, while funds from the less successful projects will be redirected.

Richard Spencer said for Try, Test and Learn to be most effective, it needs to draw on the real-life experiences of vulnerable people and their trusted community support workers to identify measures worth trialling.

This article was first published on Pursuit. Read the original article.

Banner Image: Les O'Rourke