Beyond the electoral cycle: How long-term climate policy is emerging

By Jeremy Burke (BCom 2003)

Delivering meaningful emission reductions requires long-term policy to catalyse the investment required. While not widely spoken about, the good news is, this is being delivered.

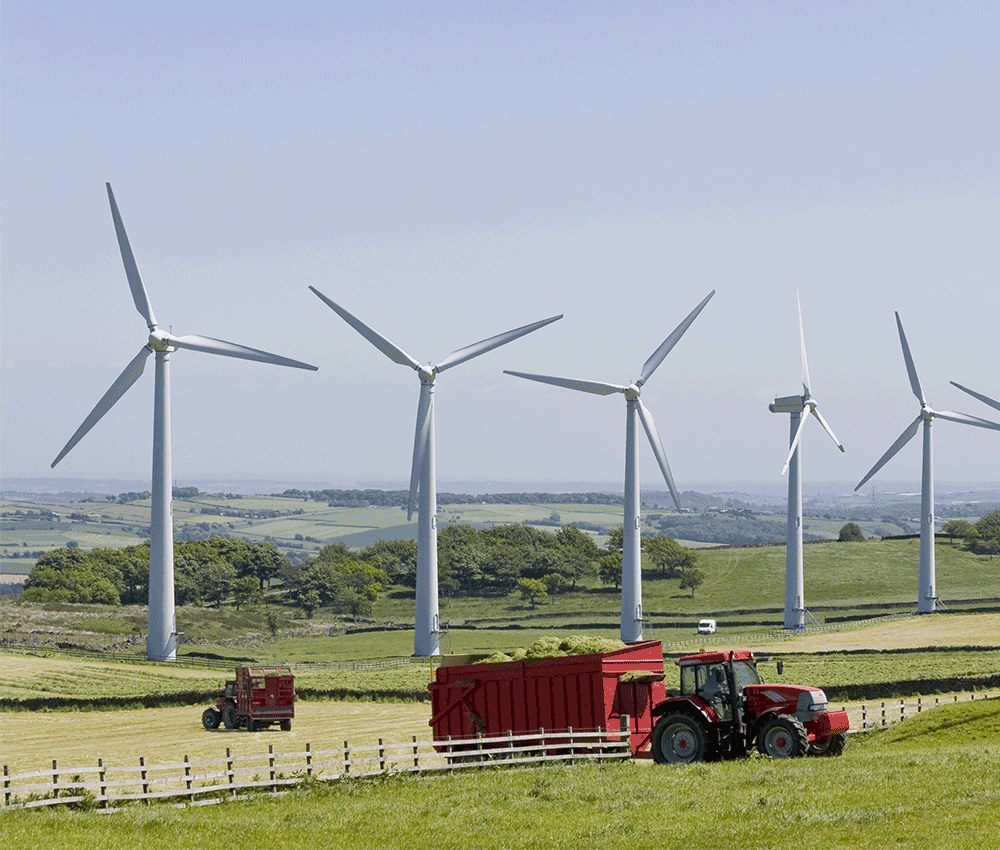

For our societies to de-carbonise, and minimise our climate change risk, we require many things. We need to create an economy-wide move away from fossil fuels, begin implementing significant changes across commerce and industry, demand more ecologically focused land management, reassess forestry and agricultural practices and facilitate a different approach to transport. Of course, the capital investment to achieve these outcomes is substantial.

The energy sector for instance, will need an estimated $11.4trn in investment by 2040 , including 68% in green power generation. Long-term policy vision from all levels of government is needed to secure large investment.

Achieving financial investment at this level is never an easy task at the best of times, let alone in a year defined by political turmoil. As we leave a particularly tumultuous period, including the UK's EU referendum vote, Australia's tight election and Turkey's attempted coup, it is time for political leaders to lead.

With last December's Paris Climate Change Agreement providing an impetus for action we see significant policy movement across the world. Change is coming, and with it will come long-term impacts on economies and societies. Investors and businesses are taking note.

From an international perspective there have been two major developments initiated to create change:

G20 Green Finance Study Group

Task Force on Climate-related financial disclosures

Looking at the individual areas of focus around the globe, we can see policies at a national level providing clarity on the long-term investment environment. France, Germany and the United Kingdom have recently made some key policy announcements.

| Country | Area of Focus | Policy |

|---|---|---|

| France | Emissions pricing | Announced a domestic carbon tax, focusing on coal-fired power stations |

| Germany | A new approach to electricity generation | Developing its Power Market 2.0, to both deploy more environmentally friendly power and move its most polluting coral plants to a strategic capacity reserve. |

| United Kingdom | Legislating for emission reductions | Under its world-leading Climate Change Act the UK has confirmed its fifth carbon budget, which will see a reduction in emissions of 57% below 1990 level in 2030. |

Further momentum will build in coming months, as countries ratify the Paris Agreement and Canada delivers its emissions reduction plan/

These policies all encourage long-term investment decisions. To obtain greater investment, countries need long-term vision defining their direction, no tactical, short-term, decisions for political expediency. Governments should be implementing policy that unambiguously shows they are committed to transitioning to a low-carbon future.

Yes, it requires political determination, but our collective response to climate change will define our age. All political leaders should seize the opportunity to step up to the challenge; it could just define their legacy.

Jeremy Burke was awarded the University of Melbourne's Faculty of Business and Economics Rising Star award for Young Alumni in 2015. Jeremy has been based in London since 2007 where he has been an investor, policy maker and campaigner on environmental issues. He has been at the UK Green Investment Bank since its establishment in 2012 and is a Trustee at CDP Worldwide.

Nominations are now open for the 2017 Alumni of Distinction Awards.

Find out more and nominate here.